48 one may reasonably assume that the irs would take a position consistent with letter ruling 201523014 and only permit the incremental costs as defined in regs.

Solar energy credit 2019 irs.

If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs.

Also use form 5695 to take any residential energy efficient property credit carryforward from 2018 or to carry the unused portion of the credit to 2020.

Filing requirements for solar credits.

These instructions like the 2018 form 5695 rev.

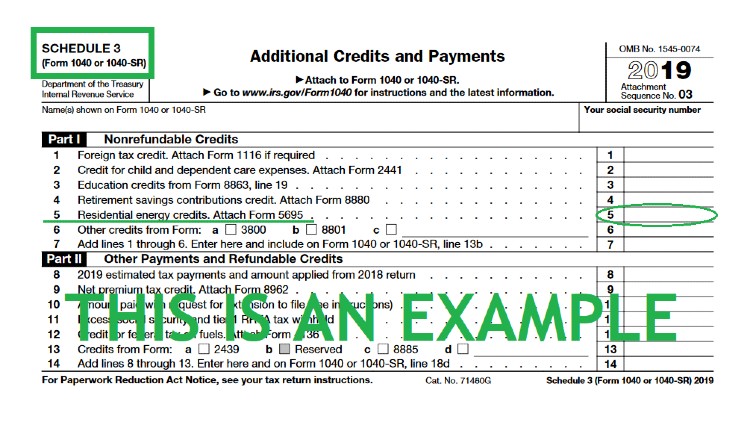

To claim the credit you must file irs form 5695 as part of your tax return.

You calculate the credit on the form and then enter the result on your 1040.

Through the 2020 tax year the federal government offers the nonbusiness energy property credit.

February 2020 have been revised to reflect the extension of the nonbusiness energy property credit to 2018 by the taxpayer certainty and disaster tax relief act of 2019.

However these credits will only apply to home modifications made through the end of 2021.

For commercial solar energy under sec.

Who can take the credits you may be able to take the credits if you made energy saving.

1 48 9 k to be included in calculating the energy credit when adding a new roof and solar panels to the property.

The itc applies to both residential and commercial systems and there is no cap on its value.

Solar wind geothermal and fuel cell technology are all eligible.

Claim the credits by filing form 5695 with your tax return.

The residential energy credits are.

The federal solar tax credit also known as the investment tax credit itc allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

Taxpayers who upgrade their homes to make use of renewable energy may be eligible for a tax credit to offset some of the costs.

This is known as the residential renewable energy tax credit.

The residential energy efficient property credit and the nonbusiness energy property credit.

The renewable energy tax credits are good through 2019 and then are reduced each year through the end of 2021.

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.