The federal solar tax credit also known as the solar investment tax credit or itc is the single most important solar incentive available in the united states.

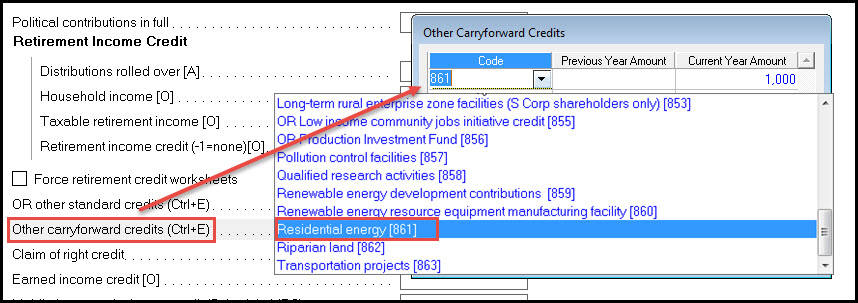

Solar energy credit carryforward.

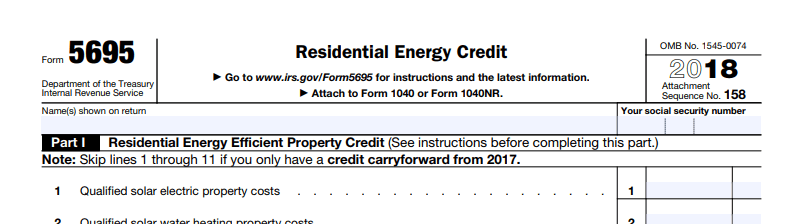

Add your renewable energy credit information to your typical form 1040.

You calculate the credit on the form and then enter the result on your 1040.

Yes the unused credit will carry forward to future years if you tax liability limits the amount this year.

Filing requirements for solar credits.

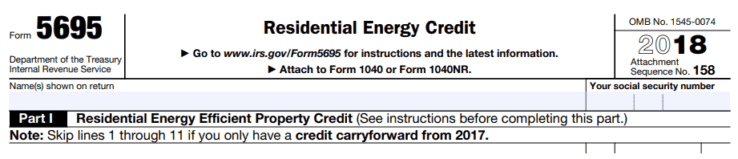

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

The residential renewable energy tax credit as the irs calls it can be an attractive way to save on the significant cost of installing solar panels or roofing an average sized residential solar.

The residential energy credits are.

To claim the credit you must file irs form 5695 as part of your tax return.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs.

However it is not yet clear whether you can carry unused credits to years after the solar credit expires.