New jersey solar panel tax credits.

Solar energy credits nj.

New jersey residents who are municipal electric oil or propane customers are eligible to participate in and receive incentives from certain programs.

To meet the rps electric companies can buy solar credits from home solar systems.

On top of these revenue streams new jersey has also granted residential solar a couple tax breaks to help keep the costs down.

New jersey s clean energy program tm was established in 2001.

That means you ll.

2 new jersey sets a renewable portfolio standard rps requiring companies that provide electricity to get a portion of its energy from renewable sources like solar power.

New jersey s board of public utilities and its clean energy program njcep promote increased energy efficiency and the use of clean renewable sources of energy energy efficiency is the easiest most cost effective way to reduce energy use and hence reduce criteria pollutant emissions and greenhouse gases.

New jersey helps residents and business owners get started with solar energy while minimizing investment and optimizing cost saving incentives.

That year there were only six solar installations in the state.

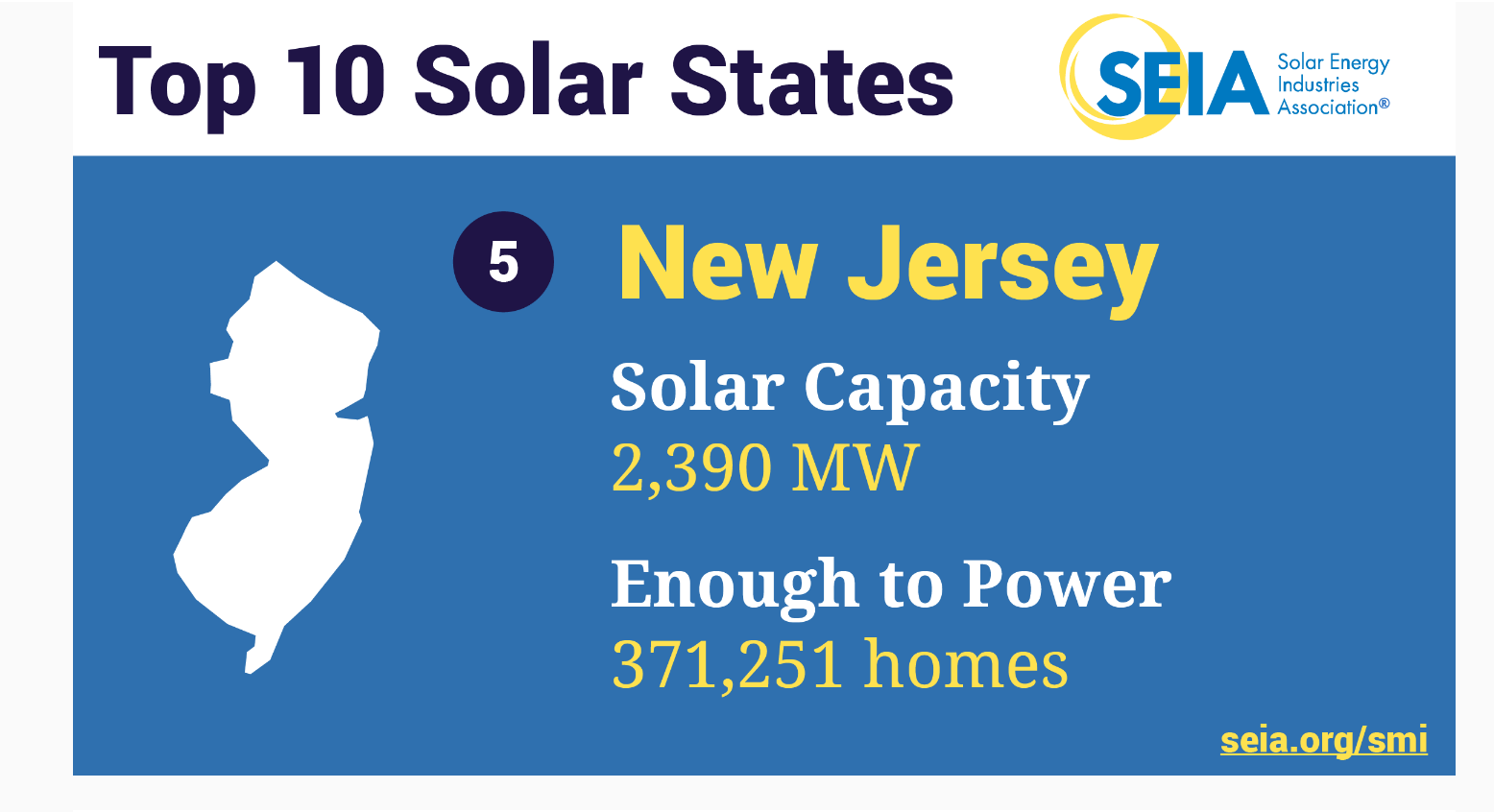

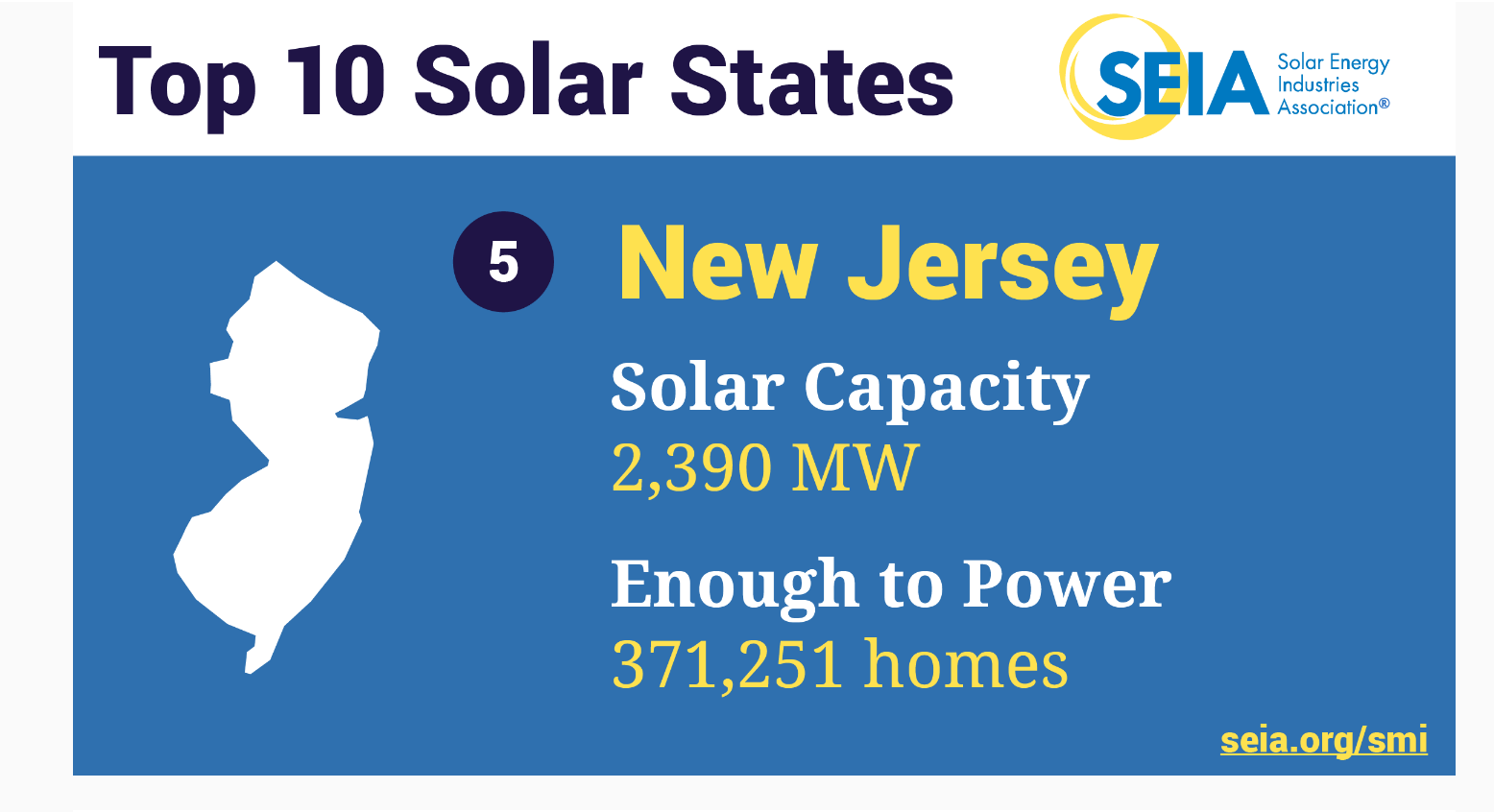

In 2018 new jersey was the seventh largest producer of solar energy and almost 75 percent of all its renewable energy production came from solar.

Solar sales tax exemption.

Solar renewable energy credits or srecs can help home solar system owners earn a return on solar.

Please check njcep for more information and availability of funds.

Since that time new jersey has established a model program and an integrated approach to solar development that includes.